Transfers between Securities (T/S, AFS, HTM) (부제. 복잡해 보이는 건 외워버리자!)

Transfers between Securities

(T/S, Available For Sales, HTM)

단기매매증권(T/S)과 매도가능증권(AFS)가 변환되는 경우가 발생한다. 시험 문제를 보면 이런 생각이 든다 "음.. 그러면 변환되는 시점의 시가를 기준으로 단순히 변환하면 되나?", "아니야...뭔가 이전 효과는 모두 Reverse 치고 이전 시점으로 돌아가 새로운 형태로 회계처리 해야 하는거 아냐?" 이런 생각들이다.

그냥 내 생각은 그렇다. 시험에는 도움 안되는 이런 쓸데 없는 생각 집어치우고 아래 Rule을 그냥 외워서 쓰자. 언젠간 이해될 것이다. 믿는다. (아님 말고)

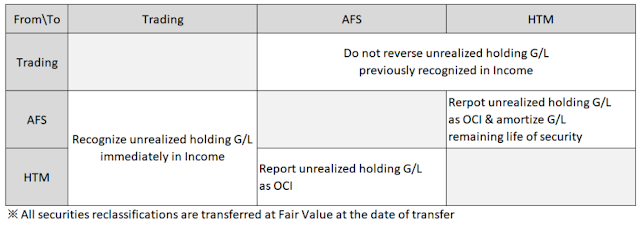

# Case by Case Summary

# Case별 분개 예제

> Condition 가정

ㆍ취득가: 50K$

ㆍFV: 60K (at the date of transfer)

1. T/S → AFS

Investment-AFS 60K Investment-T/S 60K

2. AFS → T/S

Investment-T/S 60K Investment-AFS 60K

OCI 10K Gain on T/S 10K

3. HTM → AFS

Investment-AFS 60K Investment-HTM 50K

OCI 10K

※ Unrealized holding gain → OCI

4. AFS → HTM

Investment-HTM 60K Investment-AFS 60K

OCI XXX Unrealized holding Gain XXX

※ OCI Reclassification Amortization

# 케이스별 상세 영향

1. Transfer from trading securities to available for sale

(T/S → AFS)

(T/S → AFS)

ⓐ Measurement Basis

ㆍFV at the date of transfer

→ New Cost Basis

ⓑ Impact on stockholder's equity

ㆍUnrealized gain increases stockholder's equity

(or unrealized loss decreases stockholder's equity)

※ At the date of transfer

ⓒ Impact on Net Income

ㆍUnrealized gain(or loss) is recognized in income

※ At the date of transfer

2. Transfer from available for sale to trading securities

(AFS → T/S )

(AFS → T/S )

ⓐ Measurement Basis

ㆍFV at the date of transfer

→ New Cost Basis

ⓑ Impact on stockholder's equity

ㆍUnrealized gain increases stockholder's equity

(or unrealized loss decreases stockholder's equity)

※ At the date of transfer

ⓒ Impact on Net Income

ㆍUnrealized gain(or loss) is recognized in income

※ At the date of transfer

3. Transfer from Held to Maturity to Available For Sale

(HTM → AFS)

(HTM → AFS)

ⓐ Measurement Basis

ㆍFV at the date of transfer

ⓑ Impact on stockholder's equity

ㆍThe separate component of stockholder's equity

is increased or decreased by the unrealized gain or loss

at the date of transfer

ⓒ Impact on Net Income

ㆍNone

4. Transfer from Available For Sale to Held to Maturity

(AFS → HTM)

(AFS → HTM)

ⓐ Measurement Basis

ㆍFV at the date of transfer

ⓑ Impact on stockholder's equity

ㆍThe separate component of stockholder's equity

is increased or decreased by the unrealized gain or loss

at the date of transfer

ⓒ Impact on Net Income

ㆍNone

# 관련문제

27‐28번

Sun Corp. had investments in equity securities classified as trading costing $650,000.

On June 30 of the current year, Sun decided to hold the investments indefinitely and accordingly reclassified them from trading to available for sale on that date. The investment's fair value was $575,000 at December 31 of the previous year; $530,000 at this June 30; and $490,000 at December 31 of the current year.

27. What amount of loss from investments should Sun report in its current year income statement?

28. What amount should Sun report as net unrealized loss on investments in equity securities in other comprehensive income at the end of the current year?

Source.

댓글

댓글 쓰기